September 18, 2025

August 25, 2025

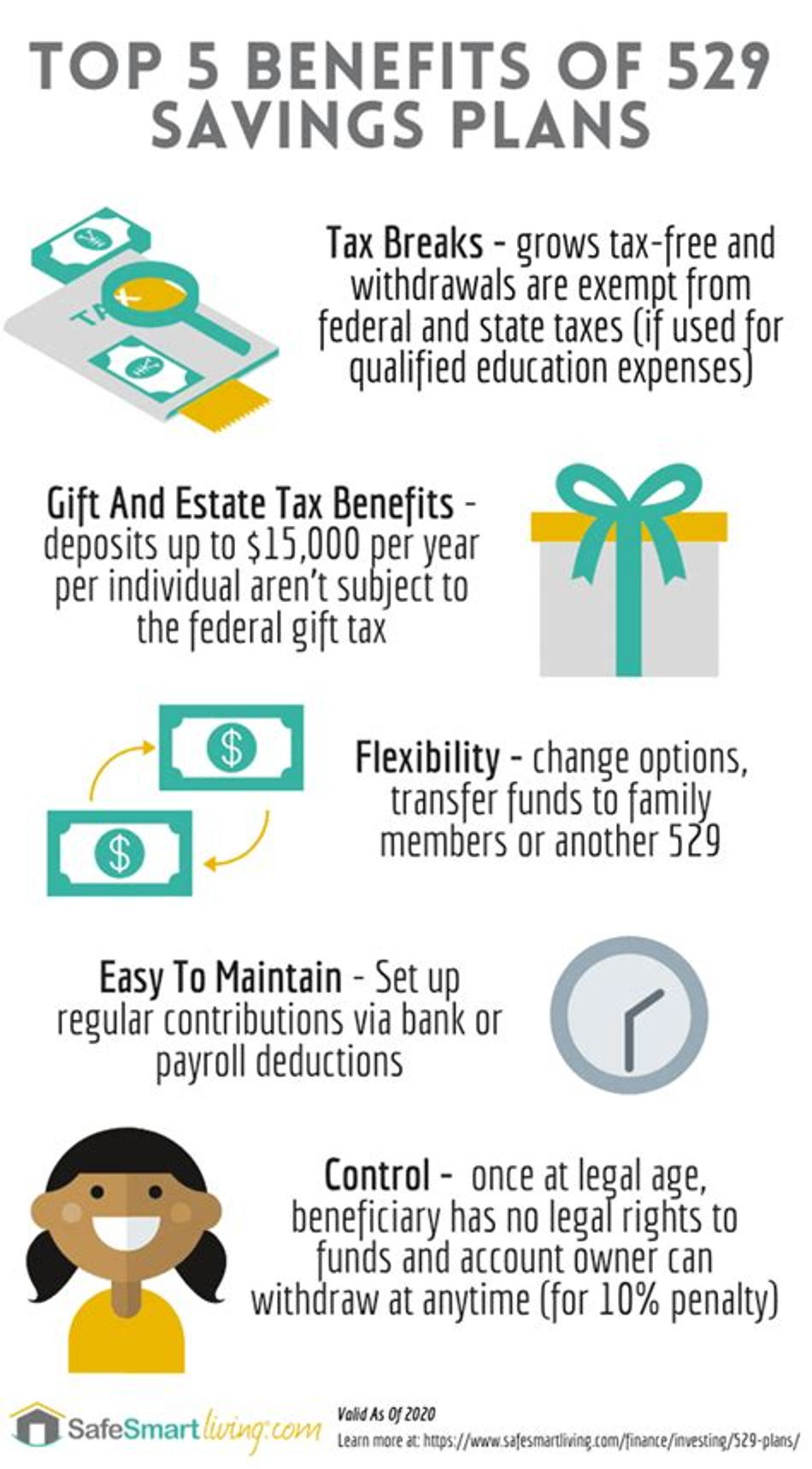

Unlocking the Power of 529 Plans: Limits, Front-Loading, and Smart Withdrawals

When it comes to saving for education, few tools are as powerful and flexible as the 529 plan.

August 25, 2025

OBBBA Impact on Small Business

The One Big Beautiful Bill Act (OBBBA), signed into law on July 4, 2025, is one of the most significant tax reforms in recent years.

June 12, 2025

Financial Strategy in 2025: What Small Business Owners Should Do in a Post-Rate Hike Economy

Financial Strategy in 2025: What Small Business Owners Should Do in a Post-Rate Hike Economy

June 4, 2025

Understanding Stagflation: A Practical Guide

Economic uncertainty is making headlines, with terms like "stagflation" drawing attention in financial conversations.

April 25, 2025

Smart Moves to Lower Your Business Tax Bill for 2025

By taking proactive steps now, you'll reduce your tax bill and bolster your business's financial health

April 10, 2025

Building a Strong Foundation for Your New Business

Launching a new business is an exciting endeavor, full of potential and challenges alike

April 5, 2025

Understanding Risk Tolerance for Smarter Investments

When managing investments, understanding your risk tolerance is crucial. It's the balance between seizing opportunities and safeguarding against potential losses.

March 28, 2025

Understanding the Social Security Fairness Act

Understanding the Social Security Fairness Act

February 20, 2025

The Influence of Politics on Stock Market Dynamics

Understanding the relationship between politics and stock market movements is essential for investors seeking to navigate these waters.

January 30, 2025

As of January 2025, under President Trump's administration, several tax policies have been proposed or enacted that may impact deductions, the Qualified Business Income (QBI) deduction, and other relevant tax provisions.